michigan gas tax increase

The last time Michigans per gallon gasoline tax was raised was 1997. Increased Gasoline Tax rate to 19 cents per gallon.

Pothole Season Is Upon Michigan Drivers Here S How You Can Report A Problem In 2022 Gas Tax Infrastructure Open Source Programs

Gasoline Diesel Fuel and Liquefied Petroleum Gas taxes recodified.

. Michigan Gas Tax Increase on Audacy. Alternative Fuel which includes LPG 263 per gallon. Compared to other states Table 1 shows Michigans gasoline tax ranked 27th in 2019 and was lower.

Diesel Fuel 272 per gallon. The 2015 legislation that increased Michigans tax rate to 263 cents per gallon in 2017 also included provisions to begin annual inflationary adjustments lesser of inflation or 5 in the tax rate beginning January 1 2022. Compressed Natural Gas CNG 0184 per gallon.

Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. The current state gas tax is 263 cents per gallon.

If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. These tax rates are based on. The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel tax.

Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents. It will have a 53 increase due. Gretchen Whitmers proposal to raise Michigan gas taxes by 45 cents per gallon is likely dead said House Democratic Leader Christine Greig Thursday.

Republicans have said the proposal is a non-starter so I think we have to have these other options the Farmington Hills representative said. The current gas and diesel tax rates are 19 cents and 15 cents per gallon respectively. Diesel Fuel 263 per gallon.

Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel. For fuel purchased January 1 2022 and after. The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents with automatic.

Whitmers proposed three-step increase over a one-year period would give Michigan the highest fuel taxes in. To increase the state gasoline and diesel taxes to between 23 cents and 30 cents per gallon depending on the wholesale price of these fuels. Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct.

Listen to Free Radio Online Music Sports News Podcasts. For fuel purchased January 1 2017 and through December 31 2021. Opponents of the Governors proposal to increase the gas tax point out that it would at current prices be a 171 increase and make Michigan the state with the highest gasoline tax in the country.

Gretchen Whitmer proposed increasing the gas tax by 45 cents in order to repair Michigan s roads. Gasoline 263 per gallon. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon.

Michael McCready R on June 17 2015. Michigans gas tax does not Todays Value increase with inflation. Public Act 176 of 2015.

In the past week Michigan gas prices have risen to an average of 425 a gallon for regular gas. Motor Fuels Taxes include the Gasoline Diesel Fuel and Liquefied Petroleum Gas and Motor Carrier Fuel Taxes. To give some relief to Michigan motorists on Wednesday the state House approved a pause of Michigans 27-cent-a-gallon gas tax for the next six months.

1 2020 an action she said would raise more than 2 billion annually to fix. The Russian invasion of Ukraine and a new ban on Russian oil imports have spurred the price spike. But both Republicans and lawmakers from her own party balked at the proposal which would have almost tripled Michigan s gas tax giving the state the highest gas taxes in the nation.

Gasoline 272 per gallon. The excise tax would reach 413 cpg in October 2019 563 cpg in April 2020 and 713 cpg in October 2020. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

Michigan Chamber of Commerce endorses gas tax hike February 01 2007 Andrew Norton The Detroit Free Press is reporting that the usually anti-tax Michigan Chamber of Commerce endorsed increases in the stateâs gasoline and diesel taxes today to hasten road and bridge repair and construction. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. Michigan gas prices have soared to a 2021 high as the average gallon of unleaded gas in the state registers at 333.

The purchasing power of 19is now 13. As of January of this year the average price of a gallon of gasoline in Michigan was 237. Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a.

The increase is capped at 5 even if actual inflation is higher. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. The gas tax will again increase from 212 cpg to 262 cpg and the diesel fuel tax will increase from 202 cpg to 27 cpg on july 1 2021.

In 2019 Democratic Gov. Increased Motor Carriers Fuel Tax rate to 21 cents per gallon with 15 cent credit for fuel purchased in Michigan. The state fuel tax is levied in addition to the federal gas tax.

LANSING Gov. Currently Michigans fuel excise tax is 263 cents per gallon cpg. Under the governors proposal a 45-cent increase would occur in three 15-cent increments over a one-year period.

They say that the proposal like others before it is not just for roads but would shift current funding already earmarked for roads from the.

Vintage Wisconsin Senate News Summer 1975 Single Sheet W Info On Both Sides

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Infographic America S Top Regulators Tout Safety Of Hydraulic Fracturing Fracking Hydraulic Oil And Gas Oil Industry

Pin On Best Semi Pro Gas Pressure Washers

Michigan Gas Tax Suspension Bill Could Be Headed For Veto Whitmer Indicates

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Oil Soaked Interest Groups Are Doing Their Best To Kill Mass Transit Billmoyers Com Interest Groups Interesting Things Gas Tax

Pin By Sally Craig On Things I Have Home Decor Furniture

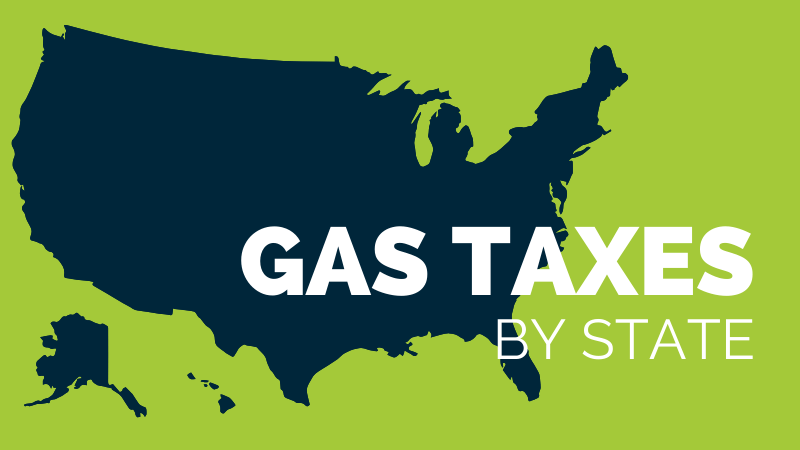

Gas Tax By State 2020 Current State Diesel Motor Fuel Tax Rates

Frases Logistica Soylogistico Option Trading Surveys For Cash Data Entry Jobs

U S States With Highest Gas Tax 2022 Statista

Michigan Gas Tax Suspension Bill Could Be Headed For Veto Whitmer Indicates

Higher Interest Rates World Wide Japan Rate Empirical Evidence

Gov Gretchen Whitmer Signals Likely Veto On Michigan Gas Tax Holiday Bridge Michigan

Fill Up Your Gas Tank Before Big Warm Up This Weekend Here S Why Hold On Gas Tanks Simple Life Hacks

1924 Ad Antique Enclosed Hudson Coach Automobile Super Six Chassis Car Car Advertising Hudson Car Automobile Advertising